The pit in my stomach was always there. Every single day. On the good days, it lingered quietly; on the bad days, it twisted and tightened like a knot I couldn’t undo. It was hard to even remember a time when it hadn’t been there. That pit was a constant reminder of my complicated, often stressful relationship with money.

That feeling started in childhood, the moment I realized I didn’t have what the other kids had. It grew during my parents’ difficult divorce, as I watched each of them struggle to provide. By the time I reached my late teens and early twenties, it was cemented: I was the only one of six college roommates who had to work full-time and pay my own rent. Financial uncertainty was the constant thread weaving through every stage of my life.

When I met my future husband, neither of us had two dimes to rub together. Not because we didn’t earn anything—we both had decent jobs, benefits, and manageable rent—but somehow, money never seemed to stick. We got engaged quickly and started saving for the wedding, and from that moment, financial pressure never let up. After we married, we purchased our first home at a reasonable price. We had leased cars, student loans, and a single credit card each. Our mortgage was modest, our home unassuming, our vehicles average, yet we constantly felt the weight of scarcity.

Then came our first baby, and the stress magnified. My heart ached to be a stay-at-home mom, but it wasn’t possible. We lived paycheck to paycheck, always robbing Peter to pay Paul, as my father used to say. Over the years, money remained the silent culprit behind so many arguments. Every January, we vowed to regain control of our finances—but year after year, the results were the same. Even as our income grew, lifestyle creep consumed the margin we’d fought so hard to create. That pit in my stomach grew heavier with each passing year. Emergencies, holidays, or small indulgences would wipe out any progress, until eventually, we hit rock bottom.

Then, one seemingly ordinary day, we saw a news story about a couple leaving a $100 tip for a waitress during the holidays. We marveled at it, dreaming quietly about one day being that kind of people. Back then, even going out to eat was a stretch. We loved giving and helping whenever we could, but never to the extent our hearts longed for. That story lingered in our minds, sparking tiny flashes of hope over the years.

One day, while browsing the website of a local church I’d been wanting to visit, I noticed an upcoming session of a popular financial class. It felt like an answer to prayer. I asked my husband if he’d attend with me. One class per week for nine weeks—he agreed. I knew he wasn’t truly enthusiastic; after years of failed attempts to manage money, skepticism was natural.

The first class, he sat stiffly, arms crossed, staring blankly at the screen as the instructor began. I worried he was hating every moment. But slowly, I saw him soften. His posture relaxed. He started paying attention. And then—a reluctant, half-crooked smile. I exhaled, feeling a glimmer of hope. We were going to be okay—but the road ahead was long. That day, we emerged from the class buzzing with excitement, already planning the steps we would take to reclaim our lives.

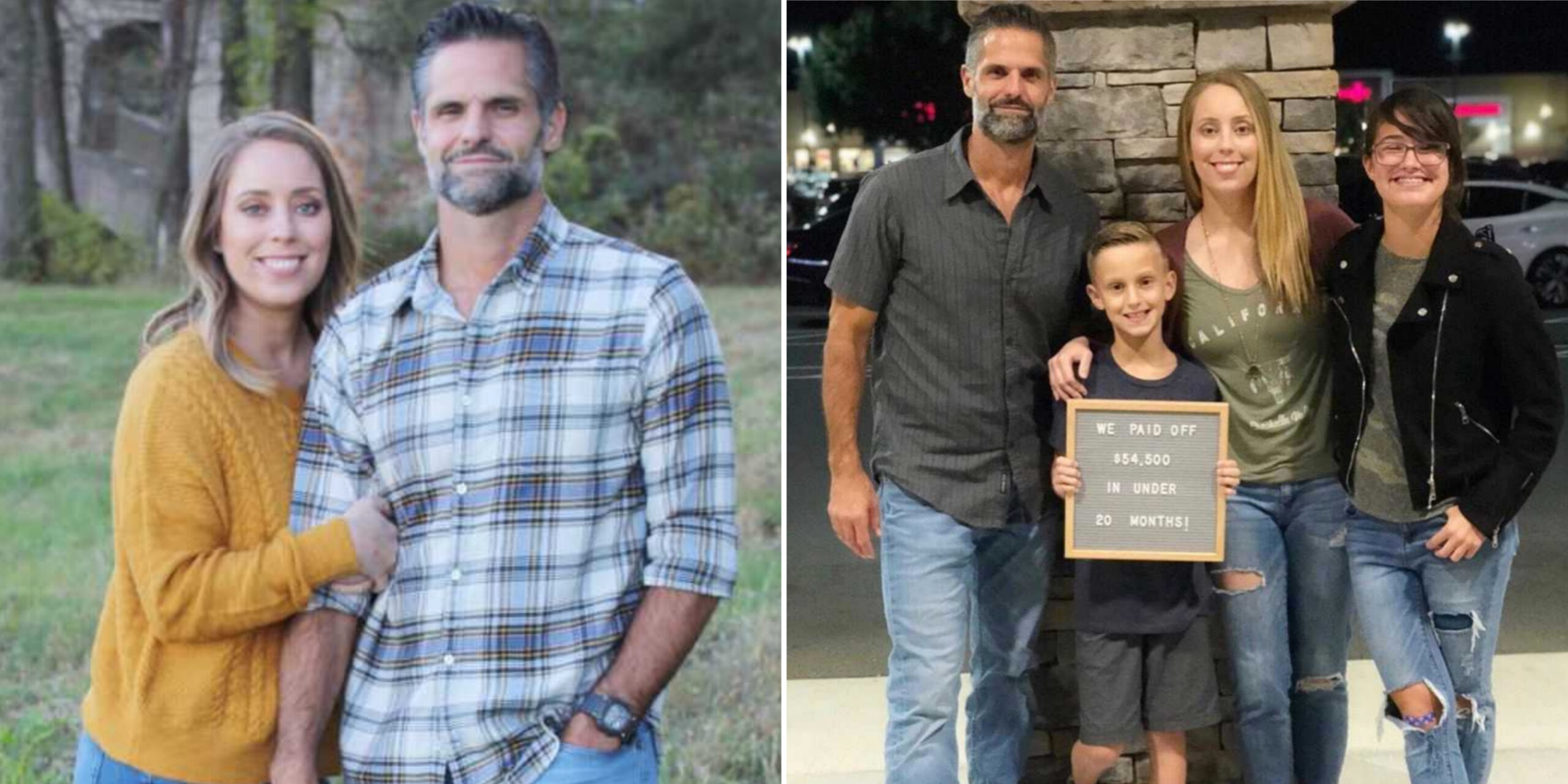

We soon discovered the full scope of our debt: $54,500, not counting the mortgage. We committed to the plan, created a monthly budget, and began diligently paying it down. Quitting wasn’t an option. Our old habits had brought us to this place of stress and worry; the only way forward was to change. We wanted to become the people who lived debt-free, saved for what they wanted, and gave generously without hesitation. We wanted to bless others freely, without first checking our own finances.

In less than 20 months, we paid off all $54,500. But we gained far more than financial freedom. We witnessed countless blessings along the way. God was moving in our lives, quietly but profoundly. Something incredible happened as we became intentional with money—we felt our hearts change. Our marriage strengthened. We gave more to our church than ever before, sponsored a child in another country, and looked for every opportunity to bless others. Our desire to give became a joyful, purposeful part of our lives.

Inspired by our journey, I started a blog sharing our experiences to empower others, providing free resources on budgeting, saving, and paying off debt. Later, I launched a YouTube channel to share weekly lessons we had learned. Our financial journey continues today. We’re not perfect; mistakes still happen, but we give generously despite not having “arrived.” We’ve learned that living a rich life isn’t about hoarding—it’s about opening your hand to bless others.

A few weeks ago, while filming a video for my channel, I shared our plan for ‘spontaneous giving’ during the holidays. We had budgeted an extra $100, planning to leave it as a tip for a restaurant server. One day, after unplanned lunch, I blurted out, “Let’s leave our waitress a $50 tip!” My husband instantly agreed. The bill was just under $30—we left $80 cash with “Merry Christmas” written on the receipt and ran out before she saw it.

We didn’t need thanks. If anything, that act was more transformative for us than the recipient. I had believed we couldn’t truly help others until we helped ourselves financially—but now I know, helping others is helping ourselves. Leaving that tip reminded us that generosity is its own reward. We had finally become “those people”: the kind of people who could give freely, live gratefully, and seize every opportunity to bless others, even when it seemed impossible.

The moments when we feel we have nothing to give are exactly the times we must give. Time, talent, or treasure—one or all three. Even in hopelessness, exhaustion, or fear, giving changes us. The holidays can be lonely and dark for so many, but in those moments, we can shine a light. And when we do, we discover the true meaning of wealth—not what we have, but what we give.